|

|

|

Select your vehicle to see available coverage options:

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full Car Insurance Coverage: A Comprehensive Guide for U.S. ConsumersWhen it comes to protecting your vehicle, understanding full car insurance coverage is essential. Whether you're driving through bustling New York City streets or cruising down the sunny highways of California, having the right coverage can provide peace of mind and financial security. What Does Full Car Insurance Cover?Full car insurance coverage isn't a single policy but a combination of different coverages that together provide extensive protection for your vehicle. Here's what you typically get:

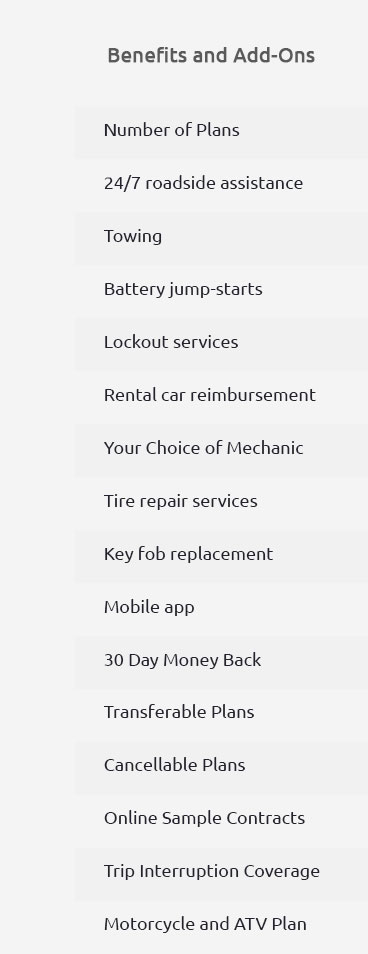

Understanding these coverages can help you make informed decisions and ensure you're fully protected. Benefits of Full Car InsuranceChoosing full coverage offers several advantages, particularly for U.S. drivers:

Cost ConsiderationsWhile full coverage can be more expensive than basic liability insurance, the long-term savings and protection are worth it. Consider the costs of potential repairs or replacements. For example, the cost to repair a luxury vehicle like a BMW can be significantly reduced with the best bmw warranty. Extended Auto WarrantiesIn addition to insurance, consider an extended auto warranty. This can further protect you from costly repairs after your manufacturer's warranty expires. For instance, purchasing a used honda warranty can save you from unexpected expenses and ensure your vehicle remains in top condition. Frequently Asked Questions

By understanding the intricacies of full car insurance coverage, U.S. consumers can make informed decisions that offer substantial protection and peace of mind. Ensure your vehicle is well-protected and consider the benefits of additional coverage options like extended warranties for a worry-free driving experience. https://www.cbsnews.com/news/is-full-coverage-car-insurance-necessary-pros-and-cons-drivers-should-know/

On the other hand, carrying full coverage may offer you peace of mind knowing that if your car is damaged, your insurance will likely cover most ... https://www.joinroot.com/coverage/full-coverage/

Apply for full coverage car insurance with Root. When you have Liability, Comprehensive, and Collision, you're prepared for almost anything. https://www.illinoisvehicle.com/insurance-basics/full-coverage

This type of auto insurance covers your vehicle in case you have an accident, unlike basic liability, which covers only the other driver's vehicle.

|